Imagine mortgage-free livingNeo is giving away mortgage payments for a year. Plus, mortgage payments for six months. Be one of the lucky winners to get up to $25,000 towards your mortgage. *

Mortgage solutions, your way

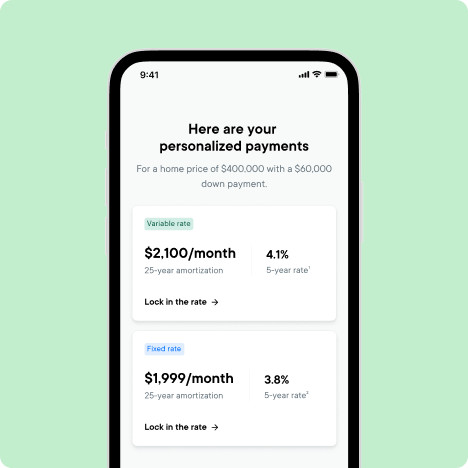

We're using technology to transform the traditional mortgage experience, making it more affordable, efficient, and accessible.Competitive ratesYour money has better things to do than pay interest. Get your best rate with Neo Mortgage—saving you more in the long run.

Quick applicationSkip the paperwork. With Neo in your pocket, you can apply for a mortgage online and get pre-qualified in minutes from wherever you are.

Dedicated supportAdvice that feels close to home. Our team of expert Mortgage Advisors is here to support you every step of the way.

Better rates than the Big 5 BanksNo surprises, no hidden fees, and no obligations - just savings.

Get your rate

4.09%Neo Mortgage¹5-year fixed rate (closed)

6.33%Big 5 Banks²5-year fixed rate (closed)

Your journey starts hereExplore your best rates online in seconds

- Apply online through our secure digital platform

- Receive personalized guidance from your dedicated Mortgage Advisor online or over the phone

- Securely submit documents from wherever you are

Whether you want to purchase or renew, we have a rate for you

Renewal or switchLock in your renewal or transfer your mortgage anytime, anywhere with our digital process.

Not a Neo client yet?We build simple products, designed to help you spend, save, and grow your money — all in one place.

Got questions?

We can answer them.

What is Neo Mortgage?

Neo Mortgage is using technology to transform the traditional mortgage experience for Canadians, getting you a mortgage faster, with a seamless digital experience.

Our platform allows customers to apply for a mortgage online, with no in-person appointments required. You’re not in this alone—our team of expert Mortgage Advisors walk you through the entire process, providing unbiased advice so you’re fully informed.

Who can apply for a Neo Mortgage?

Anyone who lives in Canada, has a Canadian photo ID, and is the age of majority in their province can apply for a Neo Mortgage.

Neo Mortgage is not available for properties in Quebec, Yukon, Northwest Territories, or Nunavut.

What do I need to apply?

To make the application process as seamless as possible, we recommend having the following information at the ready:

- Email address

- Income and employer information

- Property information

Do you do a credit check?

Anytime you apply for a mortgage or loan, your lender is required to check your credit. This is called a hard credit check or inquiry and will have an impact on your score. Neo Mortgage will not perform a hard credit check without your consent.

How do I get the lowest mortgage rate?

Many factors can affect your mortgage rate, including your credit score and debt-to-income ratio, among others.

Neo Mortgage will work with you to get the lowest rate based on your situation.

What if I prefer to talk to someone about my mortgage options?

Looking to discuss your mortgage options? Email us at mortgages@neofinancial.com and one of our expert Mortgage Advisors will be in touch.

I have a question about my Neo Mortgage.

We’re here to help! If you currently have a Neo Mortgage, our Support team can be emailed at requests@servicing.neofinancial.com. If you have questions about servicing fees, you can access our fee schedule here.

¹ 5-year fixed rate is up to date as of April 16, 2025. This rate is applicable for high-ratio mortgages and subject to lender approval. Mortgage must close within 45 days of submission.² Based on the median posted mortgage rates of Canada’s Big 5 banks taken from public websites as at April 12, 2025.³ Applicable to residential mortgages only, subject to approval. A minimum 5% down payment is required for a purchase price of $500,000 or less. For a purchase price between $500,000 and $1 million, the minimum down payment is 5% on the first $500,000 and 10% on the balance. A home purchase price of greater than $1 million requires a minimum down payment of 20%.Neo Mortgage Services Inc. Licenses - Ontario FSRA #13444, British Columbia MB600606, Alberta, Saskatchewan 510903|512351, Manitoba, Newfoundland & Labrador #2207NE1151, New Brunswick, Nova Scotia #20213000380|20223000521, PEI.‘Advisors’ are licensed mortgage professionals.