No more cookie cutter portfolios

Say goodbye to one-size-fits-all investing. Your goals, values, timelines, and risk tolerance are built into a custom portfolio designed with you at the heart of it.

Level up your online investment strategy with Neo Invest™ – powered by OneVest

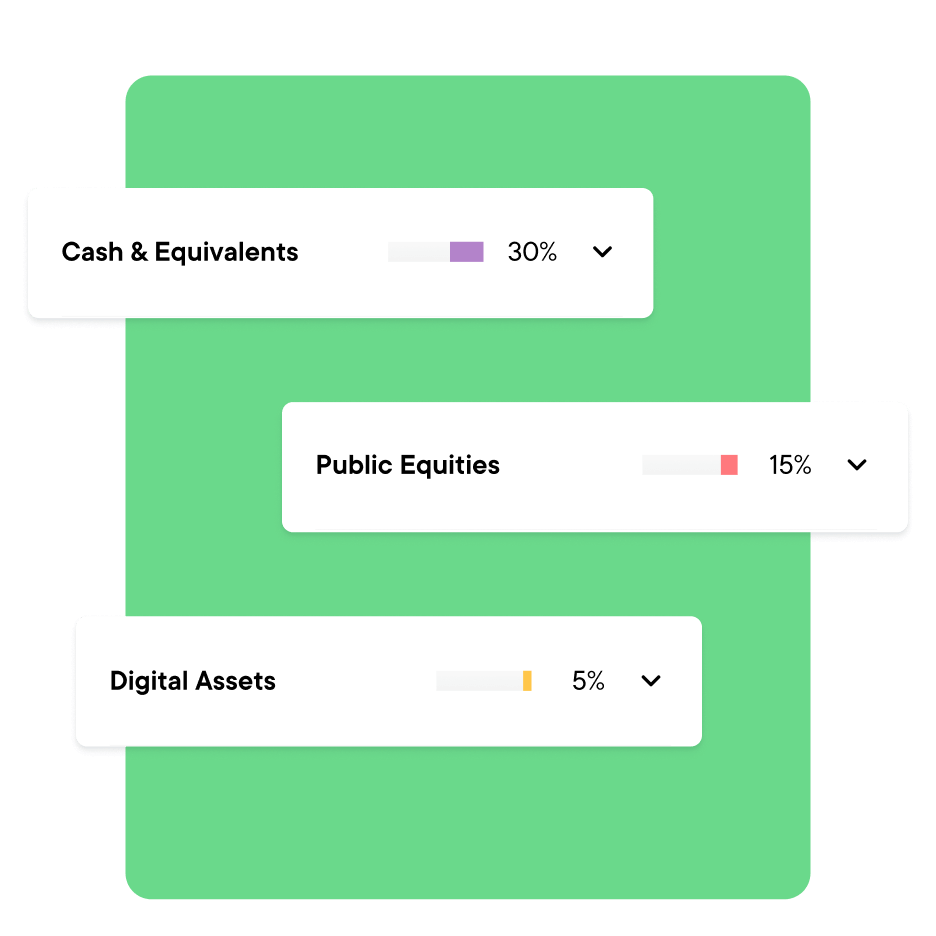

Get better potential returns with up to 3x more asset classes. Diversify your portfolio beyond basic stocks and bonds with alternative investments that help achieve better risk-adjusted returns.Invest with confidence

OneVest's portfolio managers don't like taking unnecessary risks any more than you do. They build you a diversified portfolio with multiple asset classes and investment strategies to help you achieve your investment objectives.Investment diversificationGet up to 3x more asset classes and investment strategies that help balance portfolio risk.

Personalized portfolioOneVest diversifies and adjusts your portfolio to fit your risk profile and goals.

Active managementLet a professional¹ actively manage and rebalance your portfolio and navigate changing markets.

Tax loss harvestingOneVest's portfolio managers use investment strategies that can potentially help reduce tax implications on your earnings.

Get started with online investing in Canada today.

Set up your personalized Neo Invest™—powered by OneVest¹

Got questions?

We can answer them.

Who is OneVest?

OneVest is building the future of wealth management. By pairing human touch with technology, they create personalized investment solutions to better meet your goals. OneVest is a registered Portfolio Manager in each province and territory of Canada.

What types of investments² are included?

The investments included in your portfolio are selected based on your risk comfort, financial situation, and time horizons. Your portfolio is constructed using ETFs, and they cover a range of globally diversified investments including digital assets, alternative asset classes, and more. When you complete your account set-up, we’ll teach you more about what’s in your portfolio.

What types of accounts can I invest with?

You can choose to set up your portfolios with a TFSA, RRSP, or personal account.

Your TFSA allows you to save or invest money tax-free. Any profits earned in this account (for example, investment income and capital gains) are tax-free, even when it’s withdrawn.

Your RRSP account allows you to plan for your retirement in a tax-efficient manner. Not only are profits earned in an RRSP account tax-deferred, but your RRSP contributions can also be used to reduce your income tax. You only pay tax when you withdraw money from the account.

Investing with your personal account allows you to invest your money while keeping it accessible. Personal accounts don’t have withdrawal restrictions, but you do have to pay taxes on your profits when investments are sold. This account is a good option for anyone looking to access cash in the near future or if you’ve already maxed out your TFSA and RRSP contribution limits.

Can I transfer an existing RRSP or TFSA account to Neo Invest™?

Yes! When you set up your Neo Invest™—powered by OneVest¹ account, you’ll be able to transfer partial or all funds from an existing RRSP or TFSA account into your portfolio. To learn how, read here.

What are the fees?

Fees are kept as low as possible. With traditional wealth managers, your fees could be between 1.5%-2.5%³. With Neo Invest™—powered by OneVest¹, you’ll be charged 0.75% on Assets Under Management (AUM) as a discretionary management fee, which includes all custody and trade execution charges. For example, if your account is valued at $10,000, then your annual fee is calculated as $10,000 x 0.0075 = $75 a year. The management fee is calculated based on your average daily account value and is withdrawn from your account on a monthly basis.

Some products in your OneVest portfolio may include indirect fees. These fees, called Management Expense Ratio (MER) fees, are charged within the products held in your portfolio. Depending on your portfolio, your weighted-average MER can range from 0.4% to 0.5%.

Depending on which account you invest with and where you live in Canada, the management fees you pay can also be subject to taxes.

What is a fully managed portfolio?

A fully managed portfolio means that a OneVest Portfolio Manager takes care of your investing on your behalf. Your portfolio is actively managed to take advantage of changing market conditions with the objective of maximizing your risk-adjusted return.

How can I influence my portfolio?

When you get Neo Invest™, you answer a series of questions that help customize your portfolio to your goals, timelines, and risk comfort. Your answers directly influence the type of portfolio OneVest recommends.

¹ Portfolio management services are provided by OneVest Management Inc.² The Funds are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer and are not guaranteed or insured. Their values change frequently.³ Based on research comparing the fees offered by traditional wealth management firms. Research conducted by OneVest and provided to Neo Invest in March 2022.With any investment, your capital is at risk. The value of your portfolio can go down as well as up and you may get back less than you invest. Past performance is no guarantee of future results. Read our investment risk disclosure for more information.Neo Financial™ (“Neo”) is a strategic partner of OneVest Management Inc. (“OneVest”). Through its Wealth Management-as-a-Service platform, OneVest provides wealth management products and services to Neo customers. OneVest Management Inc. is a registered Portfolio Manager in each of the provinces and territories of Canada and as an Investment Fund Manager in the provinces of Alberta, Ontario, Newfoundland and Labrador, and Quebec. Assets in your OneVest accounts are held with CI Investment Services Inc., a registered investment dealer in each province and territory of Canada, a member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.